What it means to your fixed-income portfolio

Last week on 23 rd of April, 2020, Franklin Templeton AMC has announced that it is winding up 6 of its schemes leaving investors with about 25,000 Crores jittered and the whole community shocked.

If we deep-dive to understand the underlying message, Corporate Bonds, particularly with relatively lower credit (very typical of credit risk funds) became very illiquid due to market shift towards safety and only in top rated securities. With almost no takers for lower credit, meeting redemption pressures become difficult for a mutual fund.

The Credit funds industry background & Franklin Templeton Credit Funds

The Credit Fund industry size is estimated to be around Rs. 55,000 Crs

The named six funds account for over 50% of the total industry exposure.

The named six funds also account for over 25% of the AUM of the fund house

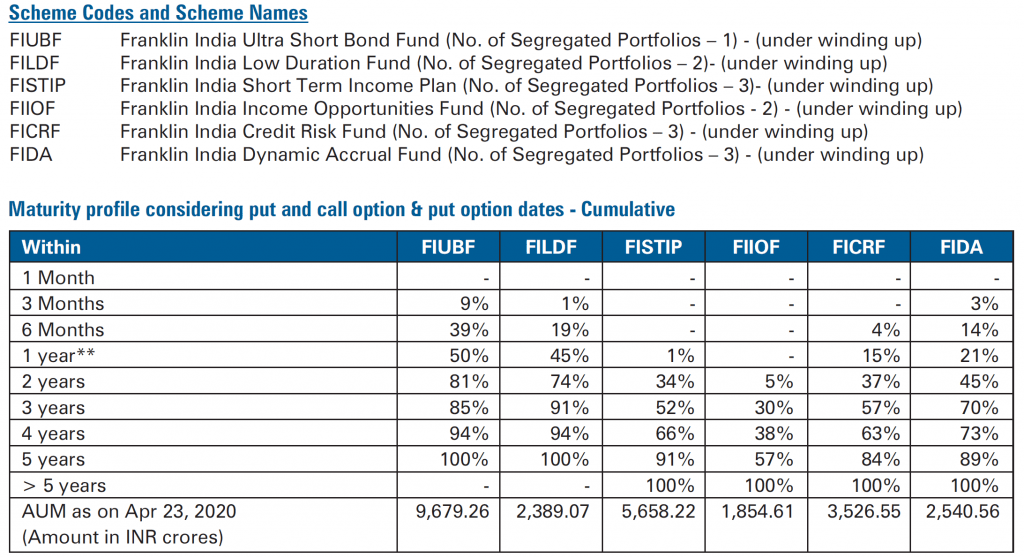

The communication and press release by the president of the AMC suggest that winding up of schemes does not mean money being written off, the AMC in the due course will collect the due cashflows based on maturity profile and return to the investor. The silver lining here is AMC can focus on seeking the maximum amount due to no redemption pressure. The maturity profile of the schemes are as follows:

Figure 1:Source-Franklin Templeton

The action by Franklin has triggered an absolute panic by the investors in the debt mutual funds with a total sell of tuning to 25,000 crores plus across debt funds irrespective of categories. The domino effect of the episode could lead to:

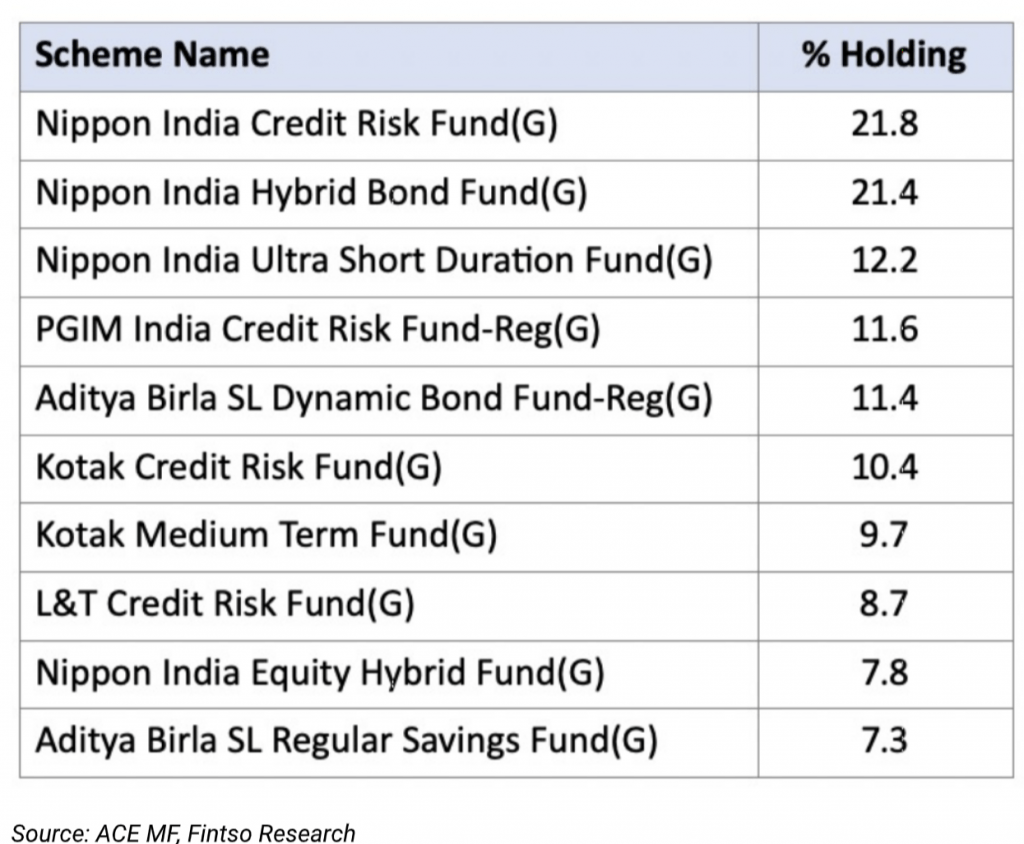

- Repricing of the bonds and cps of promotors which were lead by Franklin in those six schemes irrespective of the pressure on the business of those firms. As on 31 March 2020 the schemes with similar portfolio firms as those 6 schemes are:

- The panic move by investors and action taken by AMC’s to service the redemptions has lead to AAA bonds and Gsec yield inch up causing marked to market negative or reduced returns for investors further adding to the panic

What should an investor do?

In the midst of this panic and uncertainty an investor can perform the following steps to protect his portfolio

- Review the asset allocation:

More than permissible allocation to any asset class or security will dampen the effect of the diversification and expose to unjustified price risk

- Review of diversification:

During times like these, diversification is of utmost importance, the key us to stay focused in equity portfolio and spread out in fixed income portfolio

- Reviewing the portfolio level metrics

When we review a scheme in isolation it might suggest a different picture but when we see it in tangent to our existing portfolio it may suggest a different picture based on existing allocation and the fit in the portfolio, we recommend evaluating a scheme in reference to the portfolio for a complete picture.

- Analyse the holding overlap

When it comes to portfolio construction as investors we are of the notion that maximum schemes means high diversification but we fail to notice the overlap of underlying securities between the schemes

Key take away:

Franklin Templeton’s case is an example of how chasing the highest return without keeping in mind the associated risks could lead to dramatic results. although the schemes are not written off. Nonavailability of the liquidity is a big set back to the investors.

In the midst of such unprecedented times, we urge investors not to take panic-driven decisions and seek second opinion to replace uncertainty with some stability by getting your portfolio reviewed by your advisers or writing us at wealth@iventures.in for our independent feedback.

Written by:

Disclaimer: This article is for educational and informational purpose only. The data is publicly available, including information developed in-house. All information above is provided in good faith, however, we make no representation or warranty of any kind, express or implied regarding the accuracy, validity, reliability, completeness of any information. Therefore, conduct self due diligence before investing, trusting the information provided. We have included statements/opinions/recommendations in this document, which contains words, or phrases such as ”will” , ”expect”, ”should” and similar expressions or variations of such expressions that are forward looking statements. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally. All investments are subject to market risk. iVentures and any of it’s officers, directors, personnel and employees, shall not be liable for any loss. damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, as also any loss of profit in any way arising from the use of this material in any manner.