You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold – Ray Dalio

In a world full of infinite choices amongst asset classes such as Stocks, Commodity, Derivatives, Bonds, Real Estate and Hedge Fund, Global Funds and various other Mutual Fund Schemes, it is strenuous for even the most ripened investors to handpick the best return generating investment instruments.

Due to the impossibility of timing the Financial Market and predicting its massive uncertainties, it is salient for an investor to ride in a risk protectant vehicle.

Therefore, the old but gold technique of Asset Allocation is highly popular amongst investors and financial professionals. This technique suggests that an investor must not put all his capital in one asset class, sub class or industry since just like humans, the market too has it’s good and bad days.

Some days can be excellent for certain industries while havoc for the others and vice versa. Let’s take this period of COVID-19 Lockdown for instance:

Industries like Pharma, Consumer Staple, IT are blooming while industries like Aviation, Hospitality & Tourism are heartbreakingly collapsing, and the Banking sector is expected to see a downfall due to the rise in number NPAs.

Experiencing this unfortunate situation live and together, we can highly dignify the idea of Portfolio Optimization/ Asset Allocation.

Asset Allocation doesn’t wholly unfasten risk factors but it balances and minimizes risk in one’s portfolio especially under such sorrowful circumstances. To add a cherry on top, Asset Allocation also distresses the need of monitoring the portfolio daily and eventually boosts confidence of the investor. Critics comment that this technique is a recipe to generate mediocre returns but the most successful investors across the globe including Mr. Warren Buffett swear by the cruciality of Portfolio Diversification.

There is no formula to decide how an investor should allocate assets in the portfolio because it utterly depends on his personality traits such as risk appetite, return expectations, time horizon, tax constraints, liquidity requirements and goals. While this proves that asset allocation must be unreservedly customized, it is important to consider a few common pointers on asset diversification:

1. Defining your investments (purpose/goal):

An investor’s purpose of investment is the base of interest. Defining the goal of investment is the primary step of the process. An investor must ask himself WHY before worrying about the What, When, Where and How.

To break it down in simpler terms, the sequence of questions must be as follows:

1. “Why am I making this investment?”

2. “How Long would it take me to attain my goals?”

3. “When should I start?”

4. “What would be the risk and rewards?”

5. “How can I invest effectively to generate the best possible return?”

After all these questions are answered, a customised Financial Plan is prepared and put into motion.

To elaborate further, there can be numerous Financial Goals such as Real Estate purchase, Paying-off Debt, Financial Independence Target and so on.

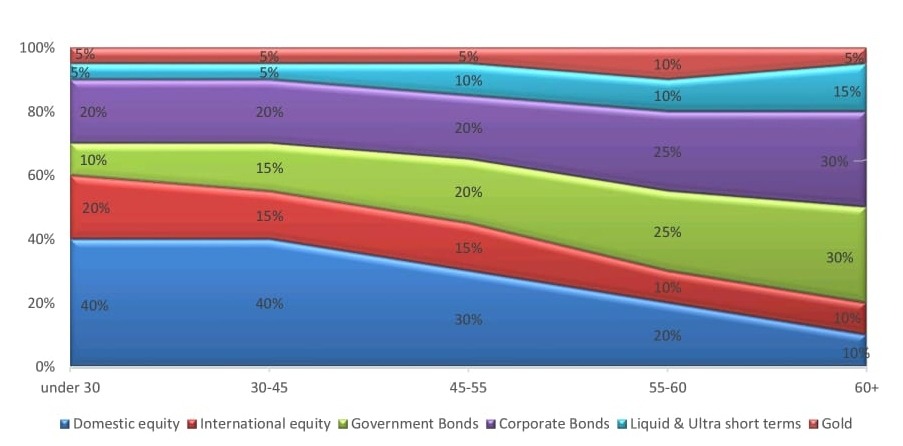

An investor’s AGE plays a crucial role in his/her goals and strategy of Asset Allocation and it can be used as an effective landmark while allocating assets in a righteous manner.

The chart shown below can firmly help one to identify the average and idealistic approach to asset distribution on the basis of AGE:

2. Time is your best friend:

Time plays a crucial role when it comes to the art of asset allocation and investing. Time has a direct link with your goals. Every goal must have a realistic Time Horizon. Once an investor accurately calculates the time horizon of his goal, the process of calculating the capital required to fulfil the purpose of investment becomes uncomplicated. Also, remember, investing is a marathon not a 10-meter sprint. Wealth creation via investing takes time. Patience is the key. Speculation can be an investor’s worst enemy.

Historically speaking, the Financial Markets have never failed to create wealth for those who patiently waited for their investments to perform and wholly swayed away speculators. Therefore, keeping your emotions (especially greed and fear) firm and unyielded is mandatory in the process of wealth generation in the markets. The longer you stay, the more you make.

3. Risk and Rewards:

Risk and Rewards are the core of any investment intention. Saying “I want to invest in the most profit providing and promising scheme” is easier said than done. Perhaps, picking highly potential stocks or funds is not the solution! The crashes of 1929, 1981, 1987, and 2008 are all examples of time frames when investing only inequity with the highest potential return was not the most prudent plan of action.

To keep it simple, there will always be an investor who attains better and more than the other. But what differs a greedy investor from a successful one is – his relationship with risk and rewards. One must stay true to himself rather than creating unrealistic expectations with risk-taking capacity or reward earnings. For instance, one must only invest a high percentage in equity if he is willing to risk that particular amount, if not then sticking to MF schemes or government bonds would be an idealistic approach.

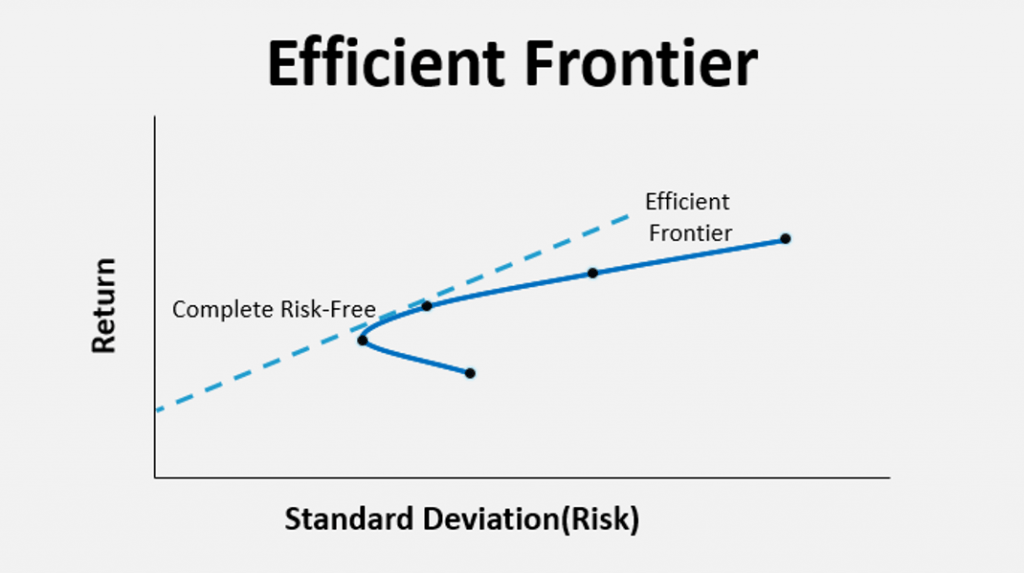

4. Efficient Frontier:

The efficient frontier graphically represents set of optimal portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. Efficient frontier can be relied on while picking out the right investments based on our risk and return appetite.

The efficient frontier rates portfolios (investments) on a scale of return (y-axis) versus risk (x-axis).

A highly risk-tolerant investor would select securities that lie on the right end of the efficient frontier as that includes securities that are expected to have a high level of risk coupled with high potential returns, which is suitable for highly risk-tolerant investors. Conversely, a risk-averse investor would choose the left side as securities that lie on the left.

5.Portfolio Rebalancing:

Portfolio Rebalancing is a rearranging technique that allows investors to reset the weightings of various assets in their portfolio periodically to maintain a desired level of risk. It safeguards the investor from being overly exposed to the risk that may appear overtime.

For example: If an investor has invested 50% in equity and 50% in bonds, overtime bonds start working in his favour, he can the shift maximum capital weightage i.e. 70-75% in bonds by selling the required percentage from equity to attain more returns.

This process helps an investor to take the best possible advantage of highly potential asset class. So, don’t forget to use this technique to maximise your ROI.

Now, Dear Investors, it’s time to get started!

Remember: It’s also never too late to give your existing portfolio a face-lift and freshness. Asset allocation is not a one-time event, it’s a life-long process of progression and fine-tuning.

Hence, the famous quote by the great investor Mr Buffett “Don’t put all your eggs in one basket” makes complete sense because if you do, you can lose it all.”

Author – Swati Yadav

Assistant Manager, iVentures Capital